In an era where financial stress can touch every corner of our lives, having a clear, practical framework is more important than ever. The Wealth Wheel offers a visual depiction of your financial state, helping you identify strengths, weaknesses, and the steps you need to take to move forward. By exploring each segment of the wheel, you gain clarity on what matters most and how to maintain momentum.

This article dives deep into the Wealth Wheel, guiding you through its eight core categories, the difference between short- and long-term goals, and how to adapt your plan as life changes. You will learn to conduct a self-assessment, set priorities, and develop a game plan that keeps you on track toward greater financial well-being.

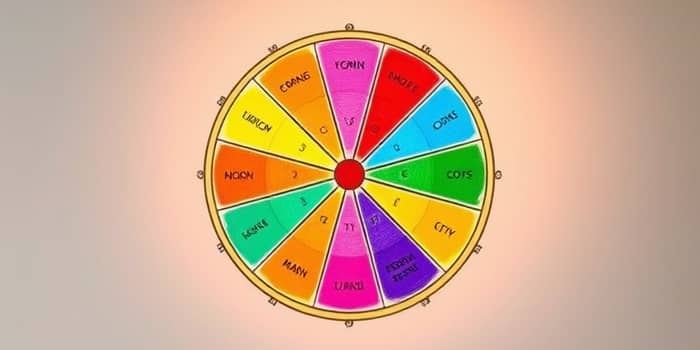

The Financial Wellness Wheel is a powerful tool that breaks down personal finance into eight interconnected areas. By scoring each category, you create a snapshot of where you stand today and identify where focused effort can yield the greatest progress.

Each of these segments influences the others. For instance, improving your budgeting skills can free up funds for emergency savings, while reducing debt can boost your credit score and lower monthly expenses.

To begin, grab a worksheet or a blank piece of paper and draw a circle divided into eight equal slices. Label each slice with one of the core categories. Then, rate your satisfaction in each area on a scale from 0 (very dissatisfied) to 10 (fully satisfied). Connect the dots to form a shape within the wheel.

This exercise gives you a clear visual of your current reality. Areas where the shape dips indicate opportunities for improvement. High-scoring zones show strengths you can leverage when tackling weaker segments.

Balancing immediate needs with future security is crucial. The Wealth Wheel differentiates between:

Start by focusing on the foundation—budgeting sets the stage, and an emergency fund shields you from sudden shocks. As you build momentum, you can allocate more resources toward long-term objectives like retirement and legacy planning.

Life is unpredictable. A promotion, a new child, or an unexpected medical bill can shift your priorities overnight. The Wealth Wheel is designed to be adaptable to shifting life circumstances. Revisit your assessment regularly—quarterly or biannually—to adjust your focus and resources.

For example, once your emergency fund reaches your target, you might redirect monthly contributions toward debt repayment or additional retirement contributions. If a major expense looms, such as a home renovation, temporarily increase your savings allocation to that slice of the wheel.

While the wheel is a comprehensive visualization, you may find complementary tools helpful. Consider combining it with:

These frameworks can coexist, offering different lenses through which to view your progress. The key is to maintain a comprehensive plan that grows with you.

With your strengths and gaps identified, create a step-by-step plan:

Breaking the journey into manageable steps fosters momentum and prevents overwhelm. Celebrate small victories—paying off a credit card, hitting a savings milestone, or increasing your credit score.

True financial wellness goes beyond numbers. It touches on emotional well-being, security, and freedom. Money management should support your life priorities—whether that’s traveling the world, funding your children’s education, or retiring early.

By embracing the Wealth Wheel, you cultivate financial confidence and clarity of purpose. You learn to allocate resources where they matter most and to adapt proactively as life unfolds.

Remember, financial health is a journey, not a destination. The wheel may spin and shift, but with each revolution, you become more resilient, informed, and empowered. Take the first step today: draw your wheel, score your categories, and set your course toward balanced financial living.

References